What is Portugal's Golden Visa?

Portugal’s Golden Visa is a residency-by-investment program created in 2012, offering non-EU nationals the right to live, travel and invest across Europe. It’s one of the most successful and respected programs of its kind.

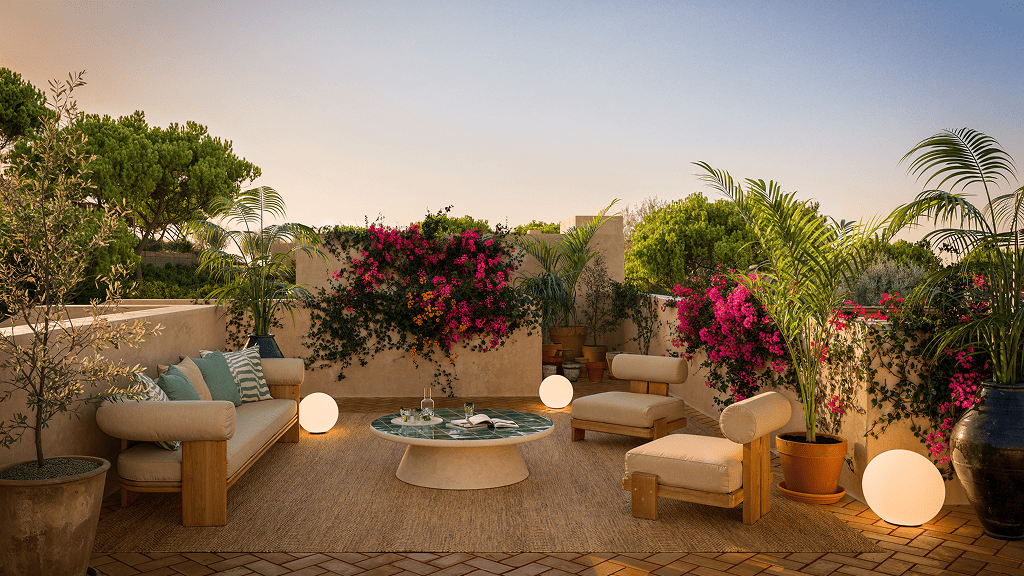

.jpg)